Private Equity Funds 101: Types and Structures

Published on January 3rd, 2023

16 min read

Published on January 3rd, 2023

16 min read

Home > Saas Resources > Private Equity Funds 101: Types and Structures

Share

Private equity is a booming asset class. In the last decade alone, the value of deals has grown from $300 billion to $3 trillion.[Source] And that’s just the start. The industry is only growing as more investors see the potential of investing in a sector that offers unparalleled control and liquidity.

Private equity funds are the investment vehicle private equity investors use to raise capital from other private investors and institutional financial institutions to purchase shares in private companies. It is a flexible and dynamic investment vehicle that offers both venture capital, and public equity investors access to high-growth companies.

But before you invest in a private equity fund, it’s essential to understand the different types of funds available. This blog post covers things you need to know about private equity funds, including definitions, structures, risks, returns, and more. Rean on to understand the ins and outs of this exciting new asset class.

A private equity fund is known as an investment vehicle that allows individuals to pool their money with other investors to buy shares in private companies. Private equity funds are often referred to as private equity firms, a term that is sometimes used interchangeably with private equity funds. These funds typically invest in a range of industries, from healthcare to technology.

It is the pool of capital that a private equity firm raises from institutional investors and other third parties to invest in other companies. The objective of a private equity fund is to generate returns through the purchase and sale of stakes in companies. The purchase price for a stake in a company may be based on its intrinsic value, discounted cash flow, or any combination of the two. The funds raised by a particular fund are used to make investments in one or more companies owned by the fund portfolio.

The purchase price for a stake in a company by a private equity fund may be above or below its intrinsic value or the value derived from discounted cash flow models. Purchases below the value of a company’s assets and liabilities are referred to as leveraged buyouts (LBOs). Purchases above the value are referred to as asset-backed securities, mezzanine financings, or sidecars.

The primary function of a private equity fund is to generate returns for its investors. Returns typically come from increases in the value of investments, dividends, or buybacks. Investors in private equity funds expect to earn double-digit rates of return with an annualized liquidity yield.

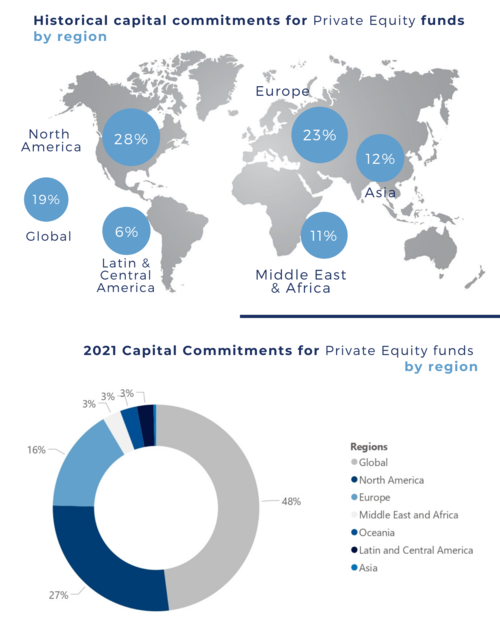

[Image Source: Phenix Capital ]

There are different types of private equity structures, and each offers a different way investors can earn returns. Generally, funds are structured as either limited partnerships or limited liability companies. Limited partnerships are structured to be illiquid, and people typically buy them as an investment strategy. Limited liability companies are structured as publicly traded companies that are more liquid. Closed ended private equity funds are not listed on public exchanges.

When a private equity fund is looking at potential investments, the first consideration is the company’s stage in its life cycle. They will then examine the company’s financials and current and future prospects. They will evaluate the management and decision-making process at the company.

When investors put money into a private equity fund, they are typically looking for the following returns:

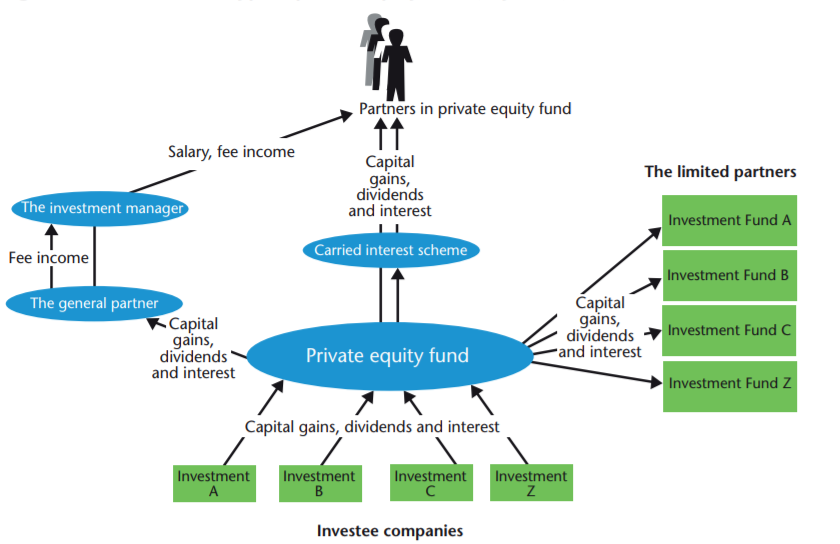

[Image Source: Money Management]

A private equity structure chart is utilized to acquire control of a company to operate it on behalf of the fund. The Company is driven in pursuit of the fund’s investment objectives, which may include growth, M&A, or refinancing. A private equity fund manager typically works with a team of professionals to support the fund during the investment process and throughout the investment tenure.

There are many fund types in the private equity industry. One standard classification divides funds into buyout (or leveraged buyout) and growth. A buyout fund targets a single company to acquire control and operate it as a going concern. A growth fund typically focuses on investing in many different companies, with the goal of generating returns that are above market-average returns by leveraging their portfolio companies. Other fund types include special situations, secondaries, mezzanine funds, core-plus funds, and distressed funds.

A Leveraged buyout (LBO) fund is an exceptional investment vehicle used to acquire and hold large companies. An LBO fund is created by investors who subscribe capital to the fund and use it to buy a large company in stages. The fund buys a company using debt and/or equity borrowed from other investors, typically via a financial institution known as a broker-dealer.

The largest capital contributor to the fund manager is the purchase of and run of the acquired company, taking on the risk of failure and potentially deriving personal financial rewards. This can be very exciting for them because it involves buying into already highly profitable businesses and undergoing significant growth.

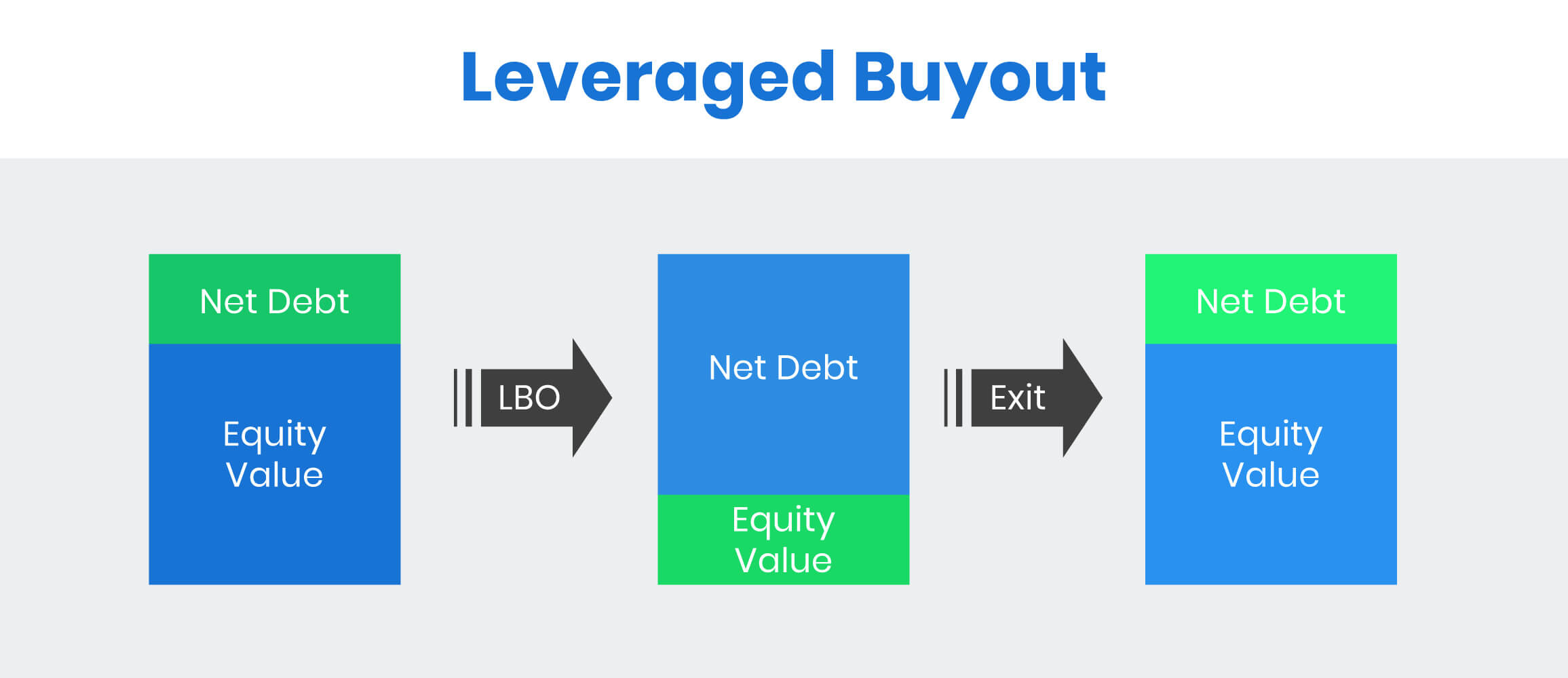

[Image Source: DealRoom]

Leveraged buyouts are usually expensive and difficult to execute, requiring substantial funds from both the buyer and the seller. Typically, the company being acquired will have existing creditors and shareholders who expect to see their money returned. So, an LBO fund uses borrowed money to make up the shortfall.

An LBO fund is constructed by raising private equity capital from investors looking for high returns in a short time period. The funds will be used to acquire an existing company with solid fundamentals, bring in new management and employees, and streamline operations. Once the acquisition is complete, the LBO fund will either sell off parts of the company or take it public.

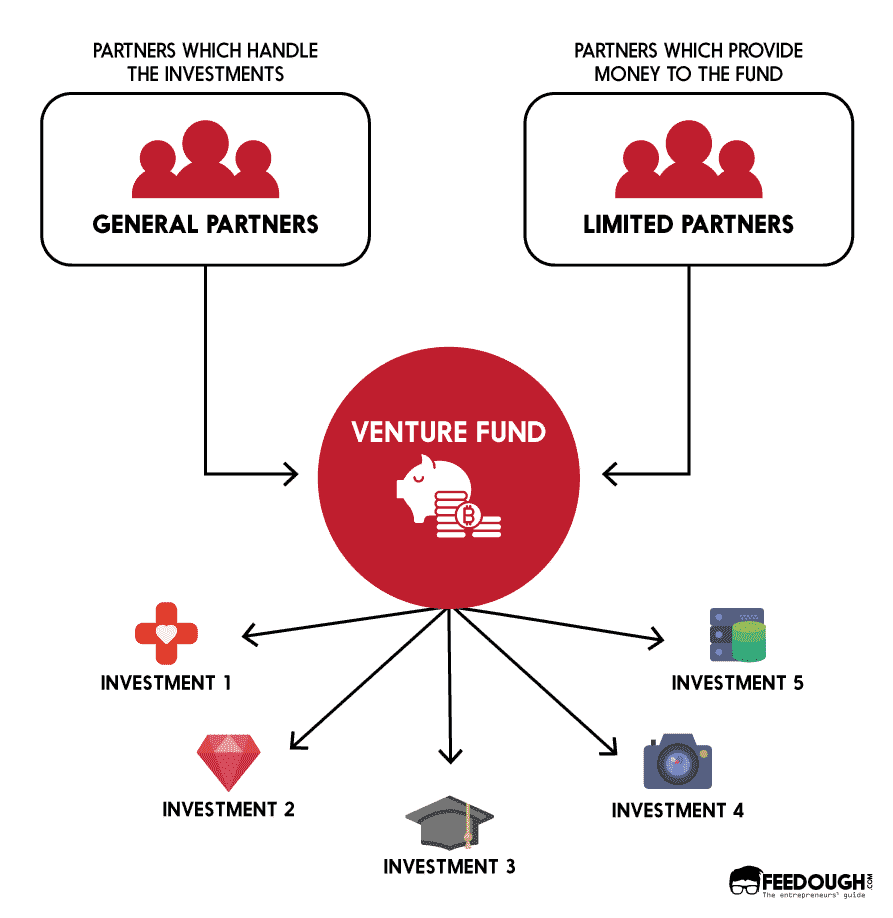

A venture capital fund is a pool of money invested by individuals, companies, or governments in early-stage companies to generate returns in the form of either capital gains or a management fee. Venture capital funds offer exposure to the debt and equity markets as well as the potential to participate in the upside of a company’s stock. The primary advantage of investing in a venture capital fund is access to both growth equity and high-quality debt financing. Companies that receive funding from a venture studio firm may also receive assistance with their product or marketing development.

Venture capital funds are often pooled together by investors who want to gain access to a wider range of startup investments. This can help investors diversify their risk and gain exposure to various investment opportunities. Because of the high-risk profile involved, venture capital funds generally have higher minimum investment requirements than other types of investment accounts. The ultimate goal of a venture capital fund is to increase the company’s value through expected profit share and/or shareholding gains.

[Image Source: Feedough]

An Absolute Return Fund private equity agreement aims to deliver returns that are purely reliant on the growth in value of underlying investments without considering the level of risk involved. This can be achieved by investing in assets that provide both growth and safety. The most common type of fund that falls into this category is a diversified fund.

This type of fund typically holds a large number of different types of investments, all with different risk and return profiles. By strategically selecting which investments to include and exclude, an absolute return fund aims to achieve returns that are uncorrelated with the overall market and uncorrelated with each other.

An Absolute Return Fund (ARF) is a type of investment fund that seeks to achieve investment returns that are not correlated with the returns on any other investments. By achieving investment returns that are not correlated with the market, the fund can provide investors with downside protection and/or upside potential that is not available from standard investments.

An Absolute Return Fund invests in a mix of stocks, bonds, and derivatives, intending to generate returns that are not correlated with the stock or bond market—i.e., returns that are not dependent on stock or bond markets for direction. The appeal of an Absolute Return Fund is that it attempts to outperform both the stock and bond markets.

By investing in stocks, bonds, and derivatives (like exchange-traded funds that track an index), Absolute Return Fund seeks to capture return potential from every asset class available to invest in. It’s worth noting, however, that an Absolute Return Fund will likely underperform a market index fund due to its higher risk tolerance and unique portfolio construction.

Specific aspects should be kept in mind when investing in a private equity fund:

A private equity fund is an often-overlooked vehicle for long-term investing. There are several reasons why investors should consider putting their money in a private equity fund. A private equity fund is designed to provide both long-term and short-term returns. This means that your investment will grow even if the market is volatile.

Also, it typically has lower costs than a mutual fund or exchange-traded fund. This means that your returns will be higher than if you invested in the stock market directly. A private equity fund has access to a team of financial experts working to build a successful company. This gives you confidence that your investment in the fund will be worth more after it is sold.

The private equity firm structure invests in companies that are either undervalued or have the potential for significant growth. By providing funds for growth, PE funds increase the value of the underlying company. In addition, PE funds have access to unique deal-making opportunities that only large investors can afford. These opportunities provide PE funds with the opportunity to create value by bringing about deals such as mergers and acquisitions, joint ventures, and divestitures.

However, there are risks with investing in private equity as an individual or institution. You may lose some or all of your investment if the company fails. Or, if the company is sold at a premium above its book value (essentially its intrinsic value), you may get only part of the gain you expect or deserve.

Private equity financing structures are investment vehicles that can be used by many types of investors, including individuals, investment banks, hedge funds, private equity firms, etc. There are many different types of private equity funds, each with its own benefits and drawbacks. Depending on the needs of the fund investors, private equity funds can provide a wide range of different investment strategies to help investors meet their risk and return preferences.

The type of fund that is the best fit for you will depend on your investment goals and the types of investments you would like to make. If you have questions about which type of fund is best for you, contact FirstPrinciples. FirstPrinciples offers more than capital. It ensures coordination with management teams providing access to our product engineering, growth, and people operations team. It offers an expert team directly with you to build the business. It gives the private equity firms operational leverage, aids in closing more deals, and provides you with credibility. Adding FirstPrinciples as an operating partner brings substantial credibility as we are a long-time player in the game!! Let’s connect to build the next success story!

Actionable insights and learnings about building and scaling SaaS companies

As the top choice for SaaS SEO, we believe in delivering quality results with the best suitable SEO Packages. It is proven that the top 3 results in Google get 92% of the traffic so we have a team of passionate digital marketers who are experts in search engine optimization.

At FirstPrinciples, we empower our people to express ideas that drive success. Our open and collaborative work culture motivates our people towards building their dream career.